Introduction

Planning for retirement can be a daunting task, but understanding your Social Security benefits is a crucial step in securing your financial future. One of the most valuable tools in this process is the Social Security Calculator. In this article, we’ll delve into what these calculators are, how they work, and why they are essential for anyone thinking about retirement.

What is a Social Security Calculator?

A Social Security Calculator is a financial planning tool designed to help individuals estimate their future Social Security benefits. These benefits, provided by the U.S. government’s Social Security Administration (SSA), serve as a vital source of income for retirees, disabled individuals, and survivors of deceased workers.

Purpose and Function

The primary purpose of a https://healthclan.us/ is to provide users with an estimate of their future benefits based on various factors, such as earnings history, age, and retirement timeline. By inputting specific information into the calculator, users can gain insights into how their benefits may change based on different scenarios.

How Does It Work?

Calculation Process

Social Security benefits are calculated using a formula that takes into account an individual’s highest-earning years, known as the Primary Insurance Amount (PIA). This formula considers the average indexed monthly earnings over a specified period and adjusts for inflation.

Primary Insurance Amount (PIA)

The PIA is the foundation of Social Security benefit calculations. It represents the monthly benefit amount a person is entitled to at full retirement age, which is typically between 66 and 67, depending on the year of birth.

Factors Considered

Several factors influence the calculation of Social Security benefits, including:

- Earnings History: Higher lifetime earnings generally result in higher benefits.

- Age: The age at which you choose to start receiving benefits can impact the amount you receive.

- Work History: The number of years worked and the amount earned in each year affect benefit calculations.

- Spousal Benefits: Married individuals may be eligible for spousal benefits based on their partner’s earnings history.

Benefits of Using a Social Security Calculator

Financial Planning

One of the significant advantages of using a Social Security Calculator is the ability to plan for retirement effectively. By understanding how different scenarios may impact their benefits, individuals can make informed decisions about when to retire and how to maximize their Social Security income.

Optimization

Calculators allow users to explore various claiming strategies to maximize their benefits. By inputting different retirement ages and income scenarios, individuals can identify the most advantageous time to begin receiving benefits.

Types of Social Security Calculators

There are several types of Social Security Calculators available to users, including:

- Online Calculators: These tools are often provided by financial planning websites and are accessible to anyone with an internet connection.

- Software Programs: Some financial planning software includes Social Security calculators as part of their suite of tools.

- Consultation Services: Financial advisors may offer personalized Social Security benefit calculations as part of their services.

Key Features to Look For

When choosing a Social Security Calculator, consider the following key features:

- Accuracy: Look for calculators that use up-to-date formulas and data from the Social Security Administration.

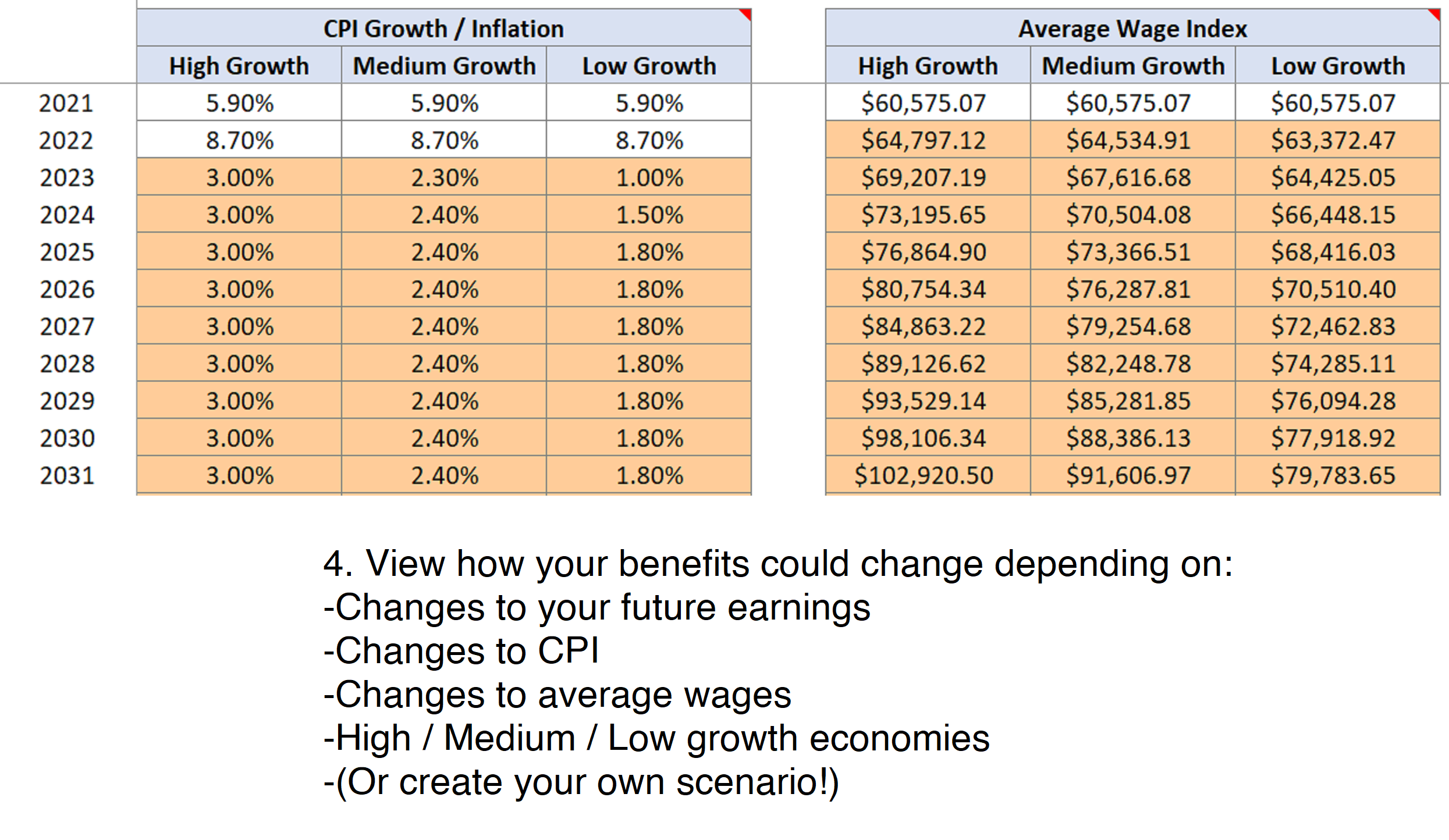

- Customization: The ability to input specific financial information and adjust assumptions based on individual circumstances.

- User-Friendly Interface: Choose a calculator that is easy to navigate and understand, even for those with limited financial knowledge.

How to Use a Social Security Calculator

Using a Social Security Calculator is relatively straightforward. Follow these steps to estimate your benefits:

- Gather Information: Collect documents that detail your earnings history and work record.

- Access a Calculator: Choose a reputable calculator from a trusted source.

- Input Data: Enter your personal information, including age, earnings history, and planned retirement age.

- Review Results: Examine the estimated benefit amounts and explore different claiming strategies.

- Adjust as Needed: Modify input variables to see how changes impact benefit estimates.

Common Mistakes to Avoid

While Social Security Calculators can be valuable tools, it’s essential to avoid common mistakes that could lead to inaccurate estimates or poor financial decisions. Some pitfalls to watch out for include:

- Ignoring Spousal Benefits: Married individuals should consider the potential impact of spousal benefits on their overall retirement income.

- Failing to Account for Inflation: Future benefit estimates should be adjusted for inflation to reflect the true purchasing power of those benefits.

- Overlooking Tax Implications: Social Security benefits may be subject to federal income tax, depending on your total income and filing status.

Conclusion

In conclusion, a Social Security Calculator is an invaluable resource for anyone planning for retirement. By providing estimates of future benefits and allowing users to explore different claiming strategies, these tools empower individuals to make informed decisions about their financial future. Whether you’re nearing retirement age or just starting your career, taking the time to understand your Social Security benefits can put you on the path to a more secure retirement.